SPARC — More Questions, No Answers

Asked to respond to analyses, the advocate of transparency has nothing to say

When people get the impression that the practices of an organization conflict with its mission or public positions, it can lead to profound reputational problems. This can be exacerbated if there is a sense that someone else is pulling the strings. This may be occurring with SPARC, which has a fiscal sponsorship arrangement with the New Venture Fund (NVF), a large fundraising non-profit affiliated with Arabella Advisors, a for-profit consulting firm.

Despite its public posture of transparency and “open by default,” SPARC exists behind a veil of secrecy, and recent attempts get answers have been met with deflections, selective answers, or silence.

About two weeks ago, Richard Poynder published an interview with Heather Joseph, Executive Director of SPARC. This followed up on some points raised in my 2018 examination of SPARC’s fiscal sponsorship, in which I suggested SPARC was sitting on a powderkeg.

Last week, inspired by Poynder’s interview, I examined SPARC anew, finding some aspects to the arrangement even more worrisome, including how NVF has progressed to become part of one of the largest liberal “dark money” fundraising machines ever seen by experts in this sort of thing.

I covered a SPARC-related initiative (OA.Works) that labels itself a non-profit even though it is not, and it does not abide by non-profit disclosure rules. I also identified a conflict of interest for Joseph, who sits on the board of a major funder of SPARC and OA.Works.

After publishing his interview, Poynder has been following these subsequent developments, and was the first to challenge SPARC and a major funder (the Arcadia Fund) to respond, tweeting one of my articles last week:

He also sought additional disclosures from SPARC Europe:

SPARC Europe is a non-profit registered in the Netherlands. Its reporting of it most recent (2019) financials is, shall we say, rudimentary.

With the Executive Director of SPARC, the CEO of the Arcadia Fund, and the director of Arcadia’s OA programs all challenged on social media to respond, nothing has been forthcoming. The CEO of the Arcadia Fund had started following my personal Twitter account the day after my first article this year about SPARC, so certainly also saw that more coverage emerged in the following days:

Monday of this week, I emailed SPARC to request a response to the various articles, and have heard nothing in reply.

SPARC has gone dark.

Yet, there seem to be even more questions . . .

Who or What Is NVF Sponsoring?

A consistent element of the publicly available fiscal sponsorship agreements I was able to find is that the sponsor (in this case, NVF) contracts either with an organization or an individual. If the sponsored entity is an organization, it is required to produce a completed IRS Form SS-4, which an entity would use to secure an employer identification number (EIN).

EINs are important for taxation purposes, as you might have surmised, and for payroll deductions and other related processes. SPARC doesn’t have a record of having ever run its own payroll — ARL seems to have handled payroll for SPARC until NVF took over in 2014. There is no EIN listed on SPARC’s site. A request for their EIN went unanswered. There is no phone number for SPARC listed, or I would have called. All grants made to SPARC are routed through NVF, and reference NVF’s EIN.

Why does this matter? If there isn’t an organization with an EIN to sponsor, a fiscal sponsor may be forced to sponsor an individual. This may mean that NVF contracted directly with Joseph or some other individual, which would make the 2014 announcement of the move from ARL and SPARC incomplete or misleading, and raise other questions about control, SPARC’s governance, and where SPARC’s funding might end up some day down the road.

Whose Lawyers?

Given SPARC’s existence as a project within NVF — and their acknowledgement that NVF provides payroll, legal, and other support in exchange for fees — we can only assume that NVF lawyers are advising SPARC as these stories and analyses come out. And the advice seems to be: stonewall.

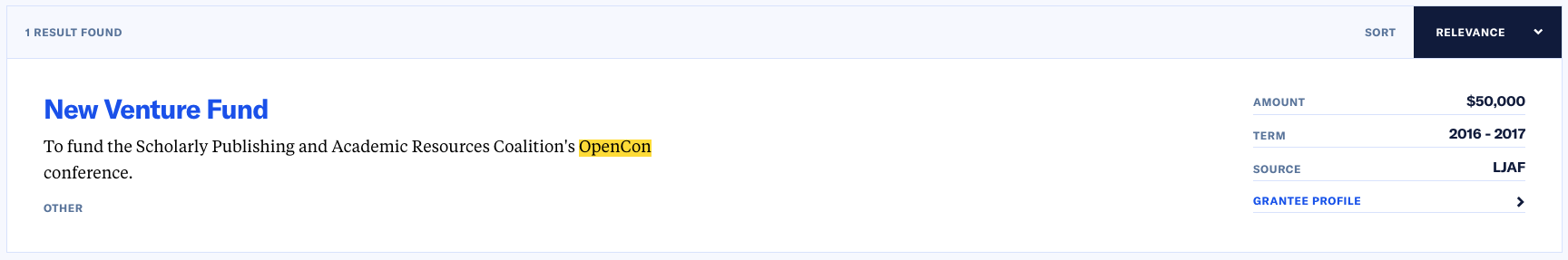

This may not be the first time NVF and its lawyers have been advising on matters pertaining to SPARC and its initiatives. It’s important to note that SPARC sponsored and received funding (via NVF) for OpenCon from the Arnold Foundation in 2016:

Joseph served on its steering committee.

When Jon Tennant was publicly sanctioned by OpenCon in 2019, NVF lawyers and two outside firms — one in the US and another in the UK — were involved on SPARC’s behalf. Public statements weren’t forthcoming beyond the initial and very terse public sanctioning, forcing Tennant and others to file a GDPR data request in an attempt to get more information about what went on.

By all appearances, a sponsor with in-house counsel and hundreds of millions in assets exerts far-reaching legal muscle behind SPARC when needed, and regularly advises deflection and stonewalling — as you might expect from a prudent corporate lawyer. However, leadership of an organization advocating transparency might overrule a lawyer’s opinions. SPARC doesn’t seem willing or able to exert itself in that manner. Given how opaque SPARC is as a result, we can only triangulate, as direct answers aren’t forthcoming, and the kind of normal disclosures or responses you’d expect from a community organization touting transparency aren’t to be had.

What Now?

What SPARC and NVF may not realize is that fallout from controversies left unanswered tends to be felt gradually, indirectly, and persistently. In 2013, when I broke the news that eLife and PubMed had been colluding, the ramifications took time to come, but they were pervasive — eLife gradually became a paper tiger and an also-ran, and NLM and PubMed leadership lost moral authority with publishers and many librarians, especially after they stonewalled. “Taking the 5th” sends a message, one that is especially repugnant to people who work in the information and trust sphere.

I think SPARC is making a mistake battening down the hatches. Even before I revisited my 2018 analysis, you could sense goodwill toward SPARC fading. SPARC’s conduct in the Tennant controversy still rankles many. Now, I think Poynder’s interview and these stories will make people take another hard look at SPARC and the gap between word and deed.

SPARC is in a bind, yet apparently they can extricate themselves easily enough. According to Joseph, SPARC is not prohibited by NVF from disclosing its financials. Can it do that, and also answer some of the questions here? Is NVF stifling those responses? Or is there something they don’t want to talk about?

Is SPARC frustrated by its inability to divulge and discuss? Or does it simply prefer its veil of secrecy?

The Geyser — Hot Takes & Deep Thinking on the Info Economy is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.