Wiley Bounces on the AI Bubble

After reeling from the Hindawi scandals, Wiley's stock recovers — but OA is deflating the entire space

I don’t live to cover stock market gyrations, but John Wiley & Sons provided an irresistible story with many twists and turns after its stock declined precipitously in the wake of a massive retraction event tied to Hindawi. Follow-on events included the ouster of its CEO and the shelving of the Hindawi brand.

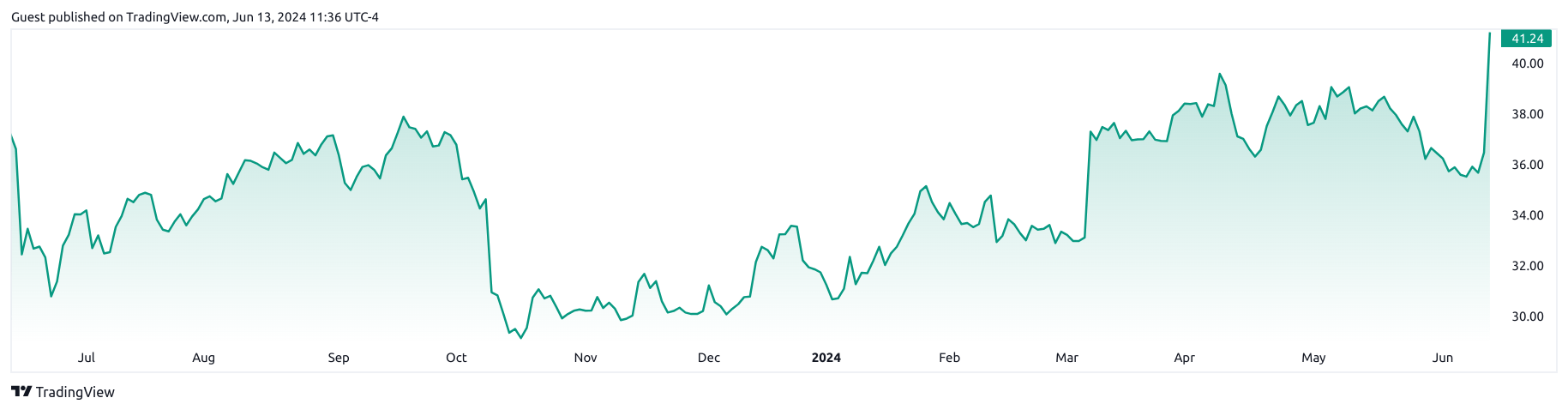

It’s been a rough ride for Wiley, but thanks in large part to the AI bubble that’s inflating stock valuations generally, Wiley’s stock price is up again, and its outlook has improved. Last week, the stock shot above $41 per share for the first time in more than a year:

This has to be taken with a large grain of salt, however — as recently as 2021, Wiley’s stock traded at more than $62/share. The underlying perceived value of the company is lower due to a variety of changes, not the least of which is its shift to OA, a problem which continues to stalk Springer Nature as it purportedly pursues yet another IPO.